Opt in for Paid Leave coverage

Paid Leave covers most Minnesota employers and employees, but there are exceptions. Self-employed people are not covered by Paid Leave unless they request to be covered AND that request is approved. If your request is approved, you will:

- Pay in to the program through premiums, like everyone else participating in Paid Leave.

- Be eligible for payments while on leave, just like other workers.

- Be eligible for up to 12 weeks of Family Leave and 12 weeks of Medical Leave per year, or 20 weeks total if you qualify for both.

Eligibility requirements to opt in for Paid Leave coverage

In order for your opt in request to be approved, you must:

- Be a resident of Minnesota.

- Make at least 5.3 percent of the state’s average annual wage in net self-employment earnings.

- Meet one of the eligibility criteria in the table below.

- Submit an opt in request following the instructions below.

| Business owner or LLC member? | Receive W2? | Reporting to IRS as a corporation? | Reporting to IRS as a sole proprietor? | Reporting to IRS as a partnership? | Independent contractor, freelancer, or gig worker? | Already covered by Paid Leave? | Can opt in to Paid Leave? |

|---|---|---|---|---|---|---|---|

| Yes | Yes |  |

|

||||

| Yes | No | Yes |  |

|

|||

| Yes | No | Yes |  |

|

|||

| Yes | No | Yes |  |

|

|||

| No | No | Yes |  |

|

Cost of opting in for Paid Leave coverage

If you request to opt in to Paid Leave coverage and your request is approved, Paid Leave will calculate the premium amount you owe. This will be 0.88 percent of your net earnings from the previous tax year, up to the Paid Leave taxable wage base. You can estimate your premium amount by using the Paid Leave premium calculator tool.

When you opt in to Paid Leave you:

- will not submit quarterly wage detail reports, and

- must pay one year of premiums in advance.

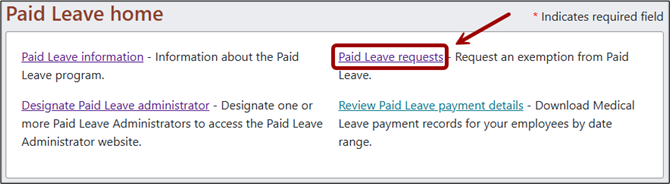

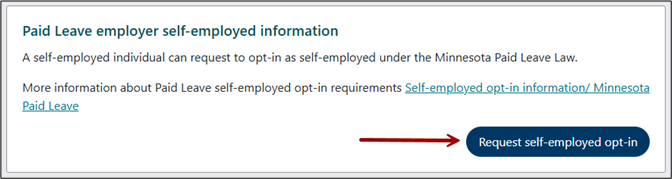

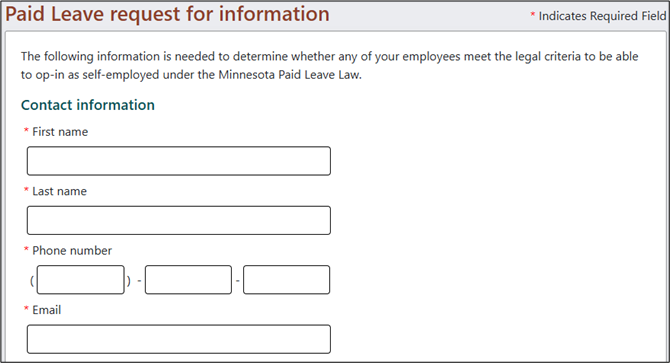

Requesting to opt in for Paid Leave coverage

Paid Leave accepts opt in coverage requests on a rolling basis. Coverage will be effective at the beginning of the quarter following 1) approval of your request to opt in, and 2) receipt of your annual premium payment. You can also choose to elect coverage beginning in a future quarter.

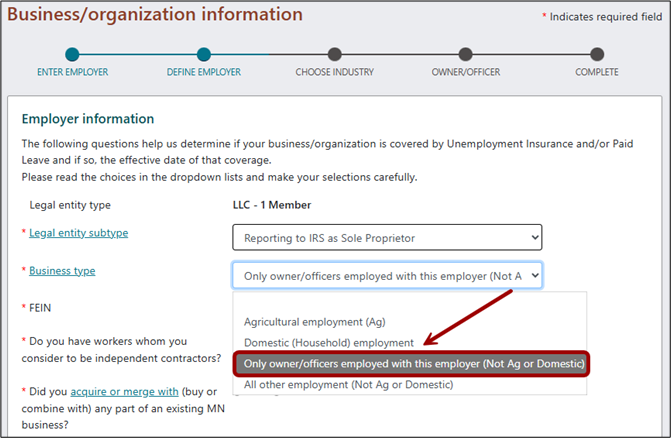

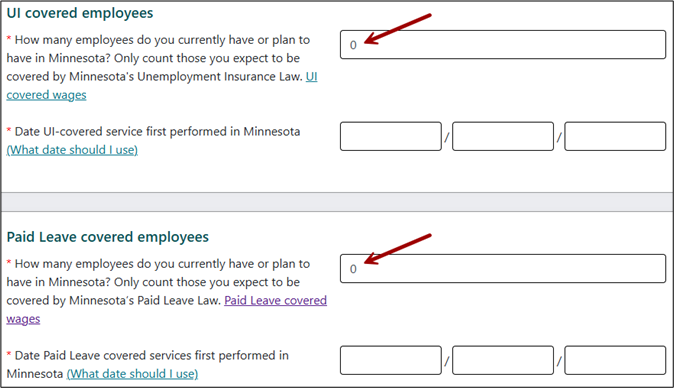

Before you can request to opt in for Paid Leave coverage, you will need to create an employer account.

After your request is submitted

Reviewing your opt-in request

The Paid Leave Division will review your request to opt in to Paid Leave coverage. You will receive an approval notification in the mail if your request is approved.

Wage detail report

If your request to opt-in to Paid Leave coverage is approved, you are not required to submit quarterly wage detail reports. You must provide required income documentation annually so additional reporting is not needed.

Paid Leave premiums

Paid Leave premiums

If your request is approved, you will receive an approval notification in the mail that will tell you how much you owe in Paid Leave premiums. You must pay one year of premiums in advance.

Coverage will be effective the following calendar quarter, or for the future elected quarter, if your request to opt-in to Paid Leave coverage is approved.

Requesting continuation of Paid Leave coverage

You will be notified before your Paid Leave coverage ends for your first year of opting in. There are steps you need to take on an annual basis to continue your Paid Leave coverage for the following year.

Complete annual request to opt-in for Paid Leave coverage

Follow the instructions as outlined above to Request self-employed opt-in.

Submit required documentation

You must provide required income documentation annually.

Pay Paid Leave premiums

Pay Paid Leave premiums

If your request is approved, you will receive an approval notification in the mail that tells you your premium payment due.

Premiums are due for the full year in advance.