Year-end tax information

IRS Form 1099-G

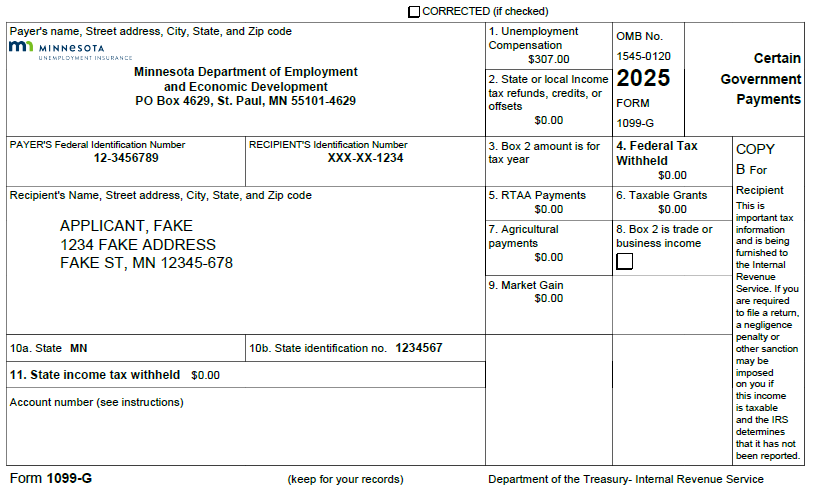

Unemployment benefits are taxable under both federal and Minnesota law. If you received an unemployment benefit payment at any point in 2025, we will provide you a tax document called the “1099-G”.

Your 1099-G will give you the information you need to accurately report your unemployment benefits on your state and federal tax returns, including:

- The total amount of unemployment benefits you were paid

- The amount of federal and Minnesota state taxes we withheld on your behalf

- Information on any overpayments you repaid

Where to find your 1099-G forms

In January, we will mail a paper copy of your 1099-G form to the address listed in your account as of December 31, 2025. Mailings will begin mid-January and finish by January 31, 2026.

If you missed the December 31st deadline to update your address, changes cannot be made for this year’s mailing. To ensure any future mailings reach you, it is important you keep your address up to date for four years – see Stopping and starting benefit payments for more information.

To get a copy of your 1099-G form, you can:

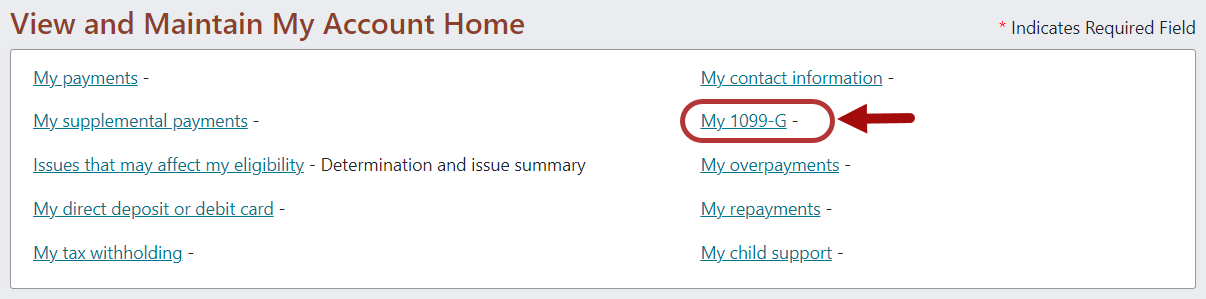

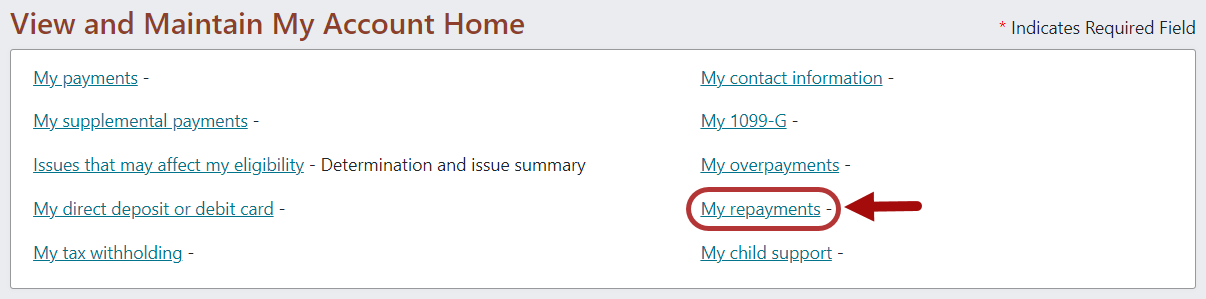

- Print current and previous year 1099-G forms using your online benefit account.

- Request a replacement copy to be mailed to your new address, once the 1099-G mailings have finished on January 31, 2026.

Understanding your 1099-G

Your 1099-G reflects the total amount of unemployment benefits you received. This includes any:

- Regular unemployment benefit payments

- Shared Work payments

- Other kinds of unemployment benefit payment

- Extended benefit payments

The total on your 1099-G includes any amounts that were withheld on your behalf, such as:

- Federal taxes

- Minnesota state taxes

- Child support

- Overpayment offsets

Your 1099-G total does NOT include benefit payments that were processed in 2026, even if those payments were for weeks in 2025.