Understanding your employer accounts

Important Paid Leave mailing arriving in December

Employers covered by Paid Leave will receive their Paid Leave Premium Rate Notice by U.S. mail in a separate mailing from the UI Tax Rate Notice. First premium payments are due April 30, 2026. To learn more visit our Paid Leave Premium Rate Notice arriving soon webpage or contact Paid Leave with questions.

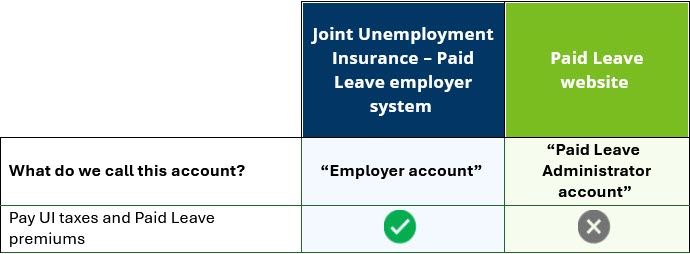

Taxes and premiums

After you submit a quarterly wage detail report, you will see screens that automatically calculate both your UI taxes/reimbursements and your Paid Leave premiums. You can make payments electronically from your employer account.

Pay quarterly UI taxes and Paid Leave premiums

UI taxes and Paid Leave premiums are calculated differently. For more information about how we calculate your:

- UI tax rate, visit our Unemployment Insurance (UI) Tax Rates page.

- Paid Leave premiums, visit Paid Leave's Premium rate and contributions page.

UI taxes are due each quarter. Paid Leave premiums will be due quarterly beginning on April 30, 2026.

Read more about payments and payment due dates.

Paid Leave premium rate reduction for small employers

Visit our Small employer premium rate page to learn how we assign reduced Paid Leave premium rates for qualifying small employers.