Updated pages to submit and adjust wage detail reports

June 7, 2023

As part of our ongoing commitment to improve your experience working with us, we updated the wage detail submission and adjustment processes.

Most employers in Minnesota submit their own quarterly wage detail reports and most of them do not find it too challenging. We have heard, however, that employers sometimes found it difficult to check for errors or complete corrections and make updates on their own. We used this feedback and data analytics to help us understand how employers complete, submit and update their wage detail records and what parts of the process slowed them down. This information, along with aligning our processes with industries performing similar tasks, guided our approach to make these steps clearer and easier for you to complete.

We’re never done – we will monitor usage, continue to gather feedback and continue making improvements. We appreciate the effort you put into submitting your wage detail and we want to make it as easy as possible for you to do quickly and accurately.

What Changed?

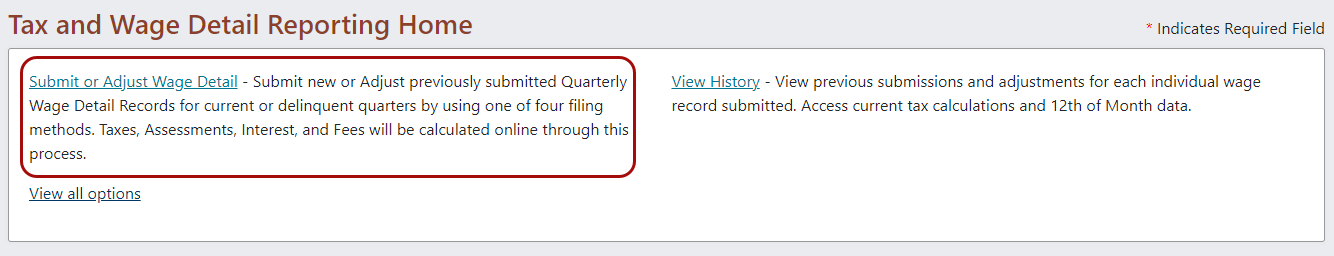

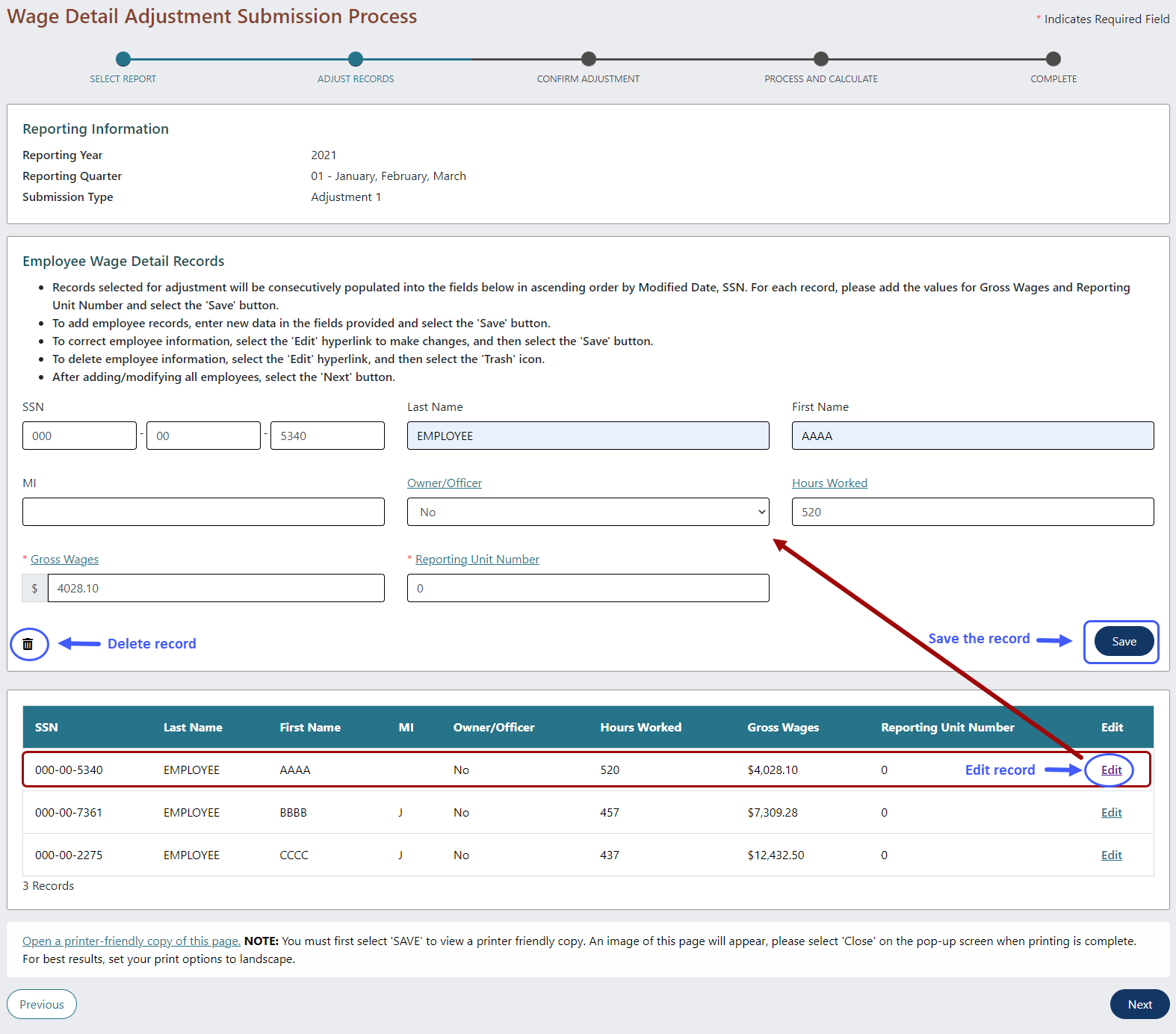

- The paths have been streamlined and choices have been made clearer.

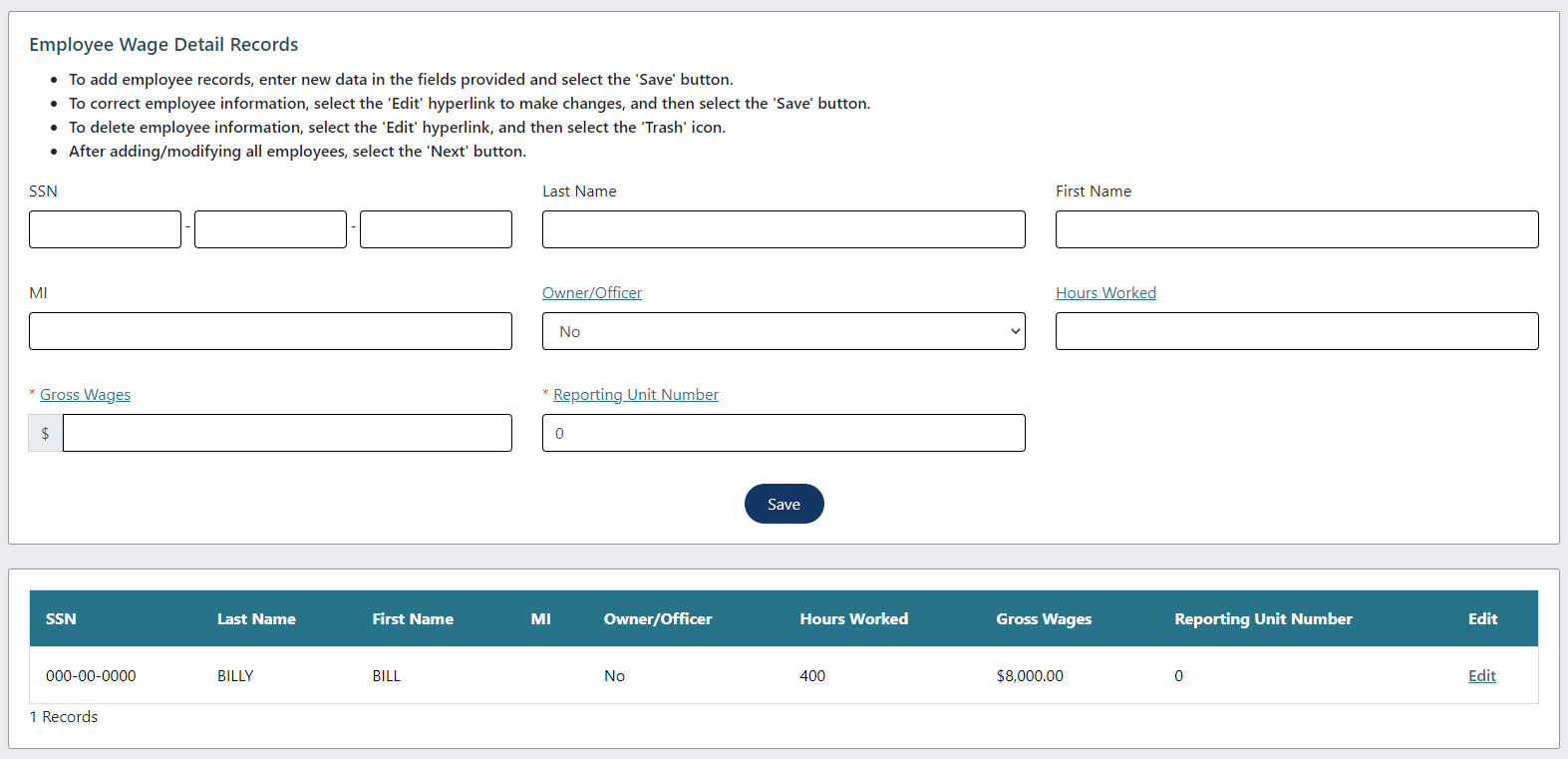

- Adding and updating records follows a more intuitive pattern.

- You will add and save one record at a time.

- You will edit and adjust one record at a time.

- Records will be saved immediately.

- Since entries are saved one record a time, you don’t need to worry about timing out before all records are entered.

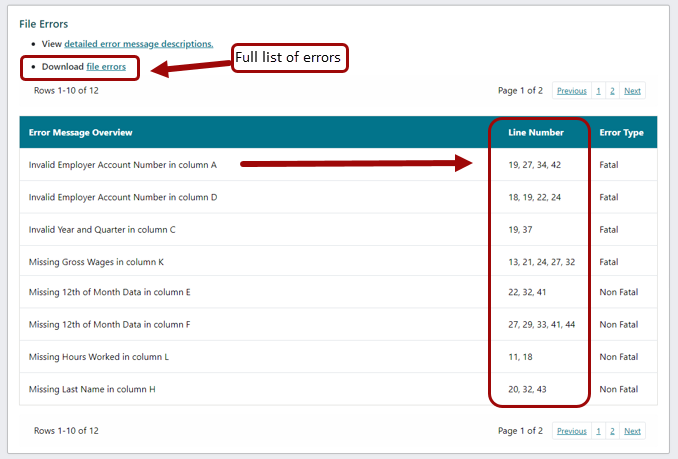

- We have grouped error messages together and made them more actionable.

- We have eliminated some options and streamlined the pages to reduce confusion for users.

What did NOT Change?

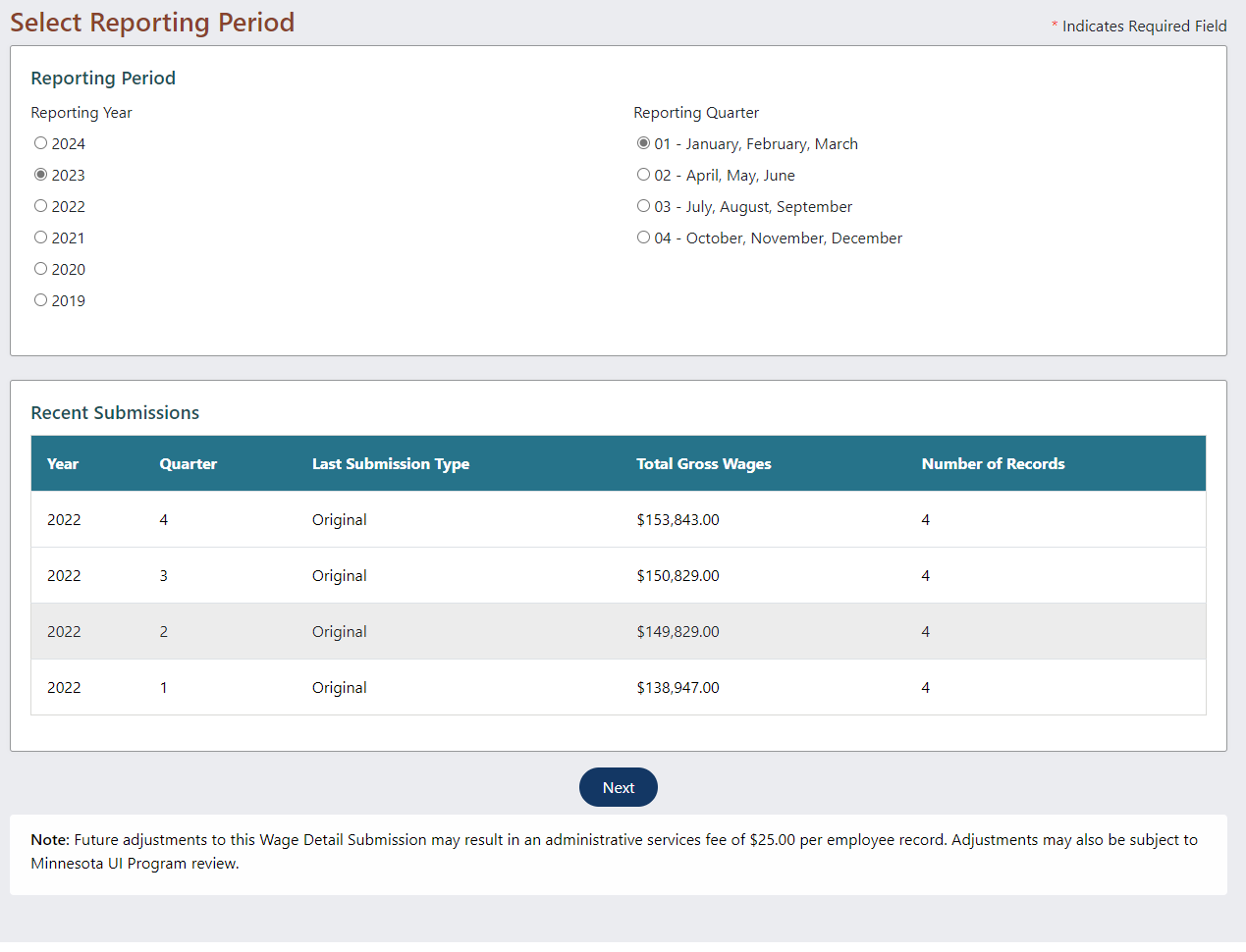

- The filing options are the same.

- You can still submit by:

- Uploading a file.

- File formats for uploading are the same – if you have gotten used to a particular format, you can keep using it.

- “Copy from previous” - where you copy and then edit a previous quarter’s wage detail.

- Manual entry of single records.

- Uploading a file.