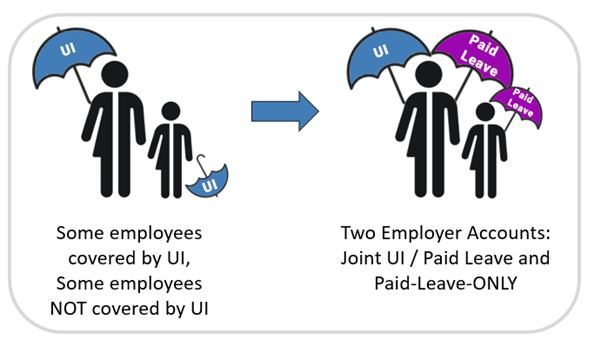

Some employees covered / some not covered by Unemployment Insurance (UI)

For Paid Leave, nearly all employment is “covered employment.” You may have some employees who are covered by both UI and Paid Leave, and some who are covered only by Paid Leave.

If you have some employees that are covered by both UI and Paid Leave and some employees that are only covered by Paid Leave, you will need to have two separate accounts: one Joint UI/Paid Leave account and one Paid-Leave-ONLY account. This will make sure that you do not pay UI taxes on your non-covered UI employees' wages; you will only pay Paid Leave premiums on their wages.

The two accounts need to have the same Federal Employer Identification Number (FEIN). We have added functionality that will allow you to create two employer accounts with a single FEIN.

- First account – is your Joint UI/Paid Leave account. This account is used to report your employees who are covered by UI and Paid Leave. We will automatically set this account up for you.

- Second account – is your Paid-Leave-ONLY account. This account is used to report your employees who are not covered by UI but are covered by Paid Leave. You will need to register for this account.

This means if you have:

- Already registered with UI - you will need to register for a Paid-Leave-ONLY account for employees not covered by UI once the functionality is ready.

- Not already registered with UI - you will need to register twice. You will register for both a Joint UI/Paid Leave account and a Paid-Leave-ONLY account.

What’s next:

- You can register for your second account (Paid-Leave-ONLY) now.

- Once you have two accounts, you will submit two electronic wage detail reports each quarter. The amounts due for Unemployment Insurance taxes and Paid Leave premiums will be calculated for you.

- The Paid-Leave-ONLY account will allow you to report wages through the UI system without being liable for UI taxes.

- Calculation of Paid Leave premiums will begin with your first quarter 2026 wage detail submission.

- First premiums for Paid Leave will not be due until April 2026.

- We will update this website with more information as we get closer to the Paid Leave program’s start date in 2026.

- If you run into an issue or have questions, please let us know. We are rolling out system functionality incrementally to assist the Paid Leave program and we know that it will take us time to get it all right. Don’t worry, we will make sure that you have plenty of time to meet Paid Leave requirements.