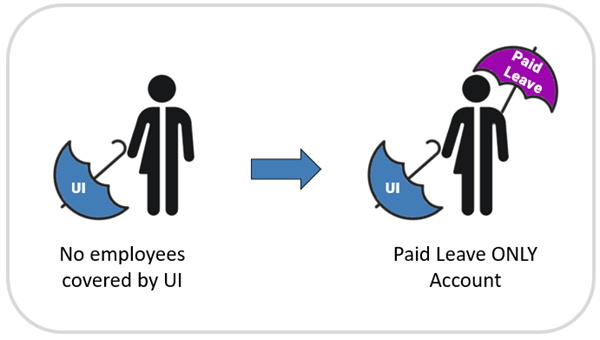

No employees covered by Unemployment Insurance (UI)

For Paid Leave, nearly all employment is “covered employment.”

This means if you have any employees, even if they are not covered by Unemployment Insurance, they are likely covered by Paid Leave.

What’s Next:

- You can register for an account now. We will ask you questions that will allow us to assign you the right kind account - either a Paid-Leave-ONLY account or a Joint UI/Paid Leave account.

- Starting in October 2024, Paid-Leave-ONLY employers will begin reporting wage detail on a quarterly basis.

- Wage detail submission and the collection of Unemployment Insurance taxes and Paid Leave premiums will take place in the current UI system.

- The Paid-Leave-ONLY account will allow you to report wages through the UI system without being liable for UI taxes.

- Calculation of Paid Leave premiums will begin with your first quarter 2026 wage detail submission.

- First premiums for Paid Leave will not be due until April 2026.

- We will update this website with more information as we get closer to the Paid Leave program’s start date in 2026.

- If you run into an issue or have questions, please let us know. We are rolling out system functionality incrementally to assist the Paid Leave program and we know that it will take us time to get it all right. Don’t worry, we will make sure that you have plenty of time to meet Paid Leave requirements.